2025 Staff

Benefits at a Glance

2025 Faculty

Benefits at a Glance

My Medical Benefits

Vermont Law School offers two (2) medical plans to its eligible faculty & staff. Coverage is provided through Cigna. Below is a snapshot of the benefits. For more complete information, refer to the SBCs and/or Certificate of Coverages.

Contributions

Eligibility

Staff working at least 30 hours per week are eligible for all benefits.

HRA Information

Pharmacy Information

MyCigna.com Resources

Discount Programs for Weight Loss

Other Plan Information

Network Information

Forms

My Telehealth Benefits

Offered through your medical plan, MDLive grants you access to virtual care 24/7. Services include medical urgent care and behavior health visits.

My HSA Benefits

My Health Savings Account Benefits

Vermont Law and Graduate School will set aside an employer contribution into an individual Health Savings Account with a partnership between TIAA-CREF and Health Equity. VLGS provides $2,500 toward your individual Health Savings Account and encourage employees to do the same. The $2,500 employer contribution will be paid out quarterly: $625 deposited in January, April, July and October. The funding provided by Vermont Law and Graduate School will be prorated for 2025 new hires.

The IRS has increased the maximum contribution for 2025 to $4,300 for individual and $8,550 for a family. The maximums include the contribution that VLGS gives employees. For participants over the age of 55 the IRS allows an additional $1,000 to be contributed.

Anyone who is ineligible for a Health Savings Account but elected the HSA plan, will receive a Health Reimbursement Account (HRA). VLGS will put $2,500 into this individual account for eligible medical expenses.

Eligibility:

Staff working at least 30 hours per week are eligible for all benefits.

My HRA Benefits

My Health Reimbursement Account Benefits

HSA Plan Participants:

Vermont Law and Graduate School employees who enroll in medical coverage and who elect the Health Reimbursement Account due to enrollment in Medicare or another health plan will receive $2,500 of funding to assist with reaching their annual deductibles. The funding provided by Vermont Law and Graduate School will be prorated for 2025 new hires.

HRA Copay Plan Participants:

Vermont Law and Graduate School will contribute to a Health Reimbursement Account

(HRA) for employees enrolled in the HRA Copay Plan. VLGS contributes $1,000 for

employee-only plans, and $2,000 for employee +1 and employee + family plans. The HRA

pays 80% of covered expenses until the funding is depleted.

Eligibility:

Staff working at least 30 hours per week are eligible for all benefits.

My FSA & DCA Benefits

The IRS does not allow an employee to have a Health Savings Account (HSA) and a Medical Flexible Spending Account (FSA). Due to this change, VLGS will only allow FSA accounts for employees who are ineligible for a Health Savings Account and who will receive a Health Reimbursement Account in lieu of an HSA. An FSA provides you an opportunity to pay for health care or dependent care expenses on a pre-tax basis. By anticipating your family’s health care and/or dependent care costs for the next calendar year, you can lower your taxable income.

LIMITED PURPOSE FLEXIBLE SPENDING ACCOUNT (LPFSA)

Funds may be used for only vision and dental expenses. Limited Purpose Flexible Spending Accounts may be used alongside your Health Savings Accounts. When coordinated with an HSA, the LPFSA can further reduce your taxes while allowing you to allocate HSA funds for other purposes – including retirement. Funds are available in full on January 1st and must be used by December 31st of the same year.

Maximum Election is up to $3,300.00 for LPFSA.*

Participants may roll over $660.00 or the current IRS maximum into the following plan year.

DEPENDENT CARE ACCOUNT (DCA)

VLGS will continue the Dependent Care Account (DCA) with Health Equity. You may use these

contributions to pay for expenses associated with providing care to children under age 13. You may elect up to a maximum of $5,000, depending on your tax filing status. Any unused dollars will be forfeited.

Maximum salary reduction:

$5,000 for a single employee or a married employee filing a combined tax return

$2,500 for a married employee filing a separate tax retur

Eligibility:

Staff working at least 30 hours per week are eligible for all benefits.

Plan Information

FSA/HSA Store

The Richards Group has entered into a partnership with Health-E Commerce, also known as the FSA/HSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending or Health Savings Accounts.

Did you know you could use your FSA/HSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA/HSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA/HSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA/HSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

To access the FSA Store please visit: https://fsastore.com

To access the HSA Store please visit: https://hsastore.com

Additional Information

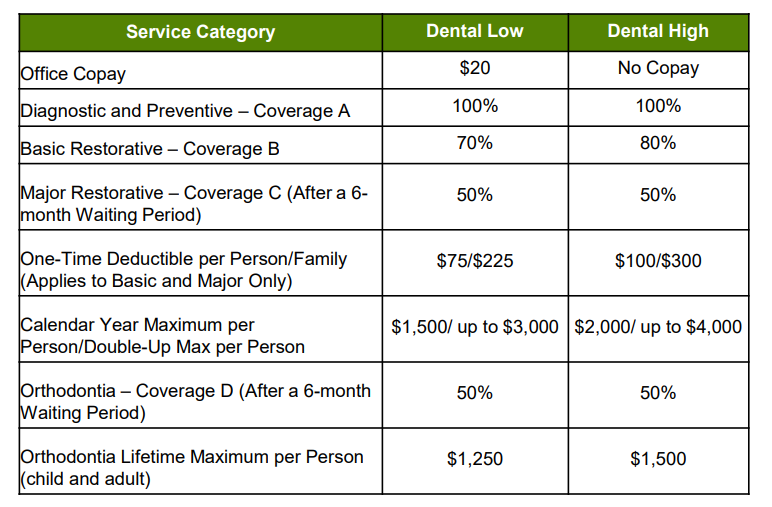

My Dental Benefits

The Vermont Law School offers two (2) dental plans to its employees:

Local Dentist Search – Please be aware that you can choose from PPO or PREMIER networks.

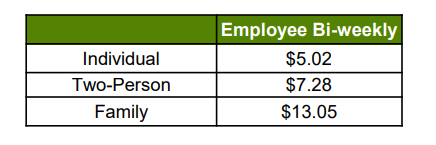

Contributions

Eligibility:

Staff working at least 30 hours per week are eligible for all benefits.

Plan Information

Northeast Delta Dental Videos

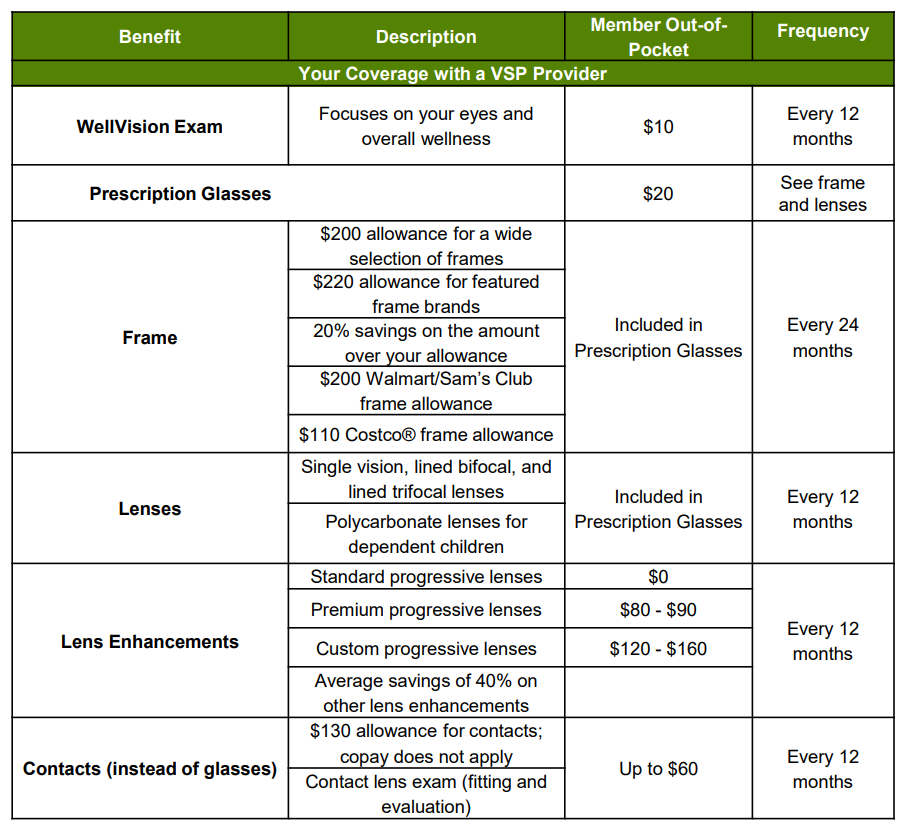

My Vision Benefits

Vermont Law School makes a voluntary vision plan available to employees and their families.

Contributions:

Eligibility:

Staff working at least 30 hours per week are eligible for all benefits.

Plan Information

My Group Life and AD&D Benefits

Your Short Term Disability Benefits

This benefit helps provide financial protection for insured members by promising to pay a

weekly benefit in the event of a covered disability. Your weekly benefit is 70% of your weekly pre-disability earnings, to a maximum of $1,500 per week. Your weekly benefit becomes payable the 1st day you are disabled for disability caused by accidental injury and after 7 days for disability caused by physical disease, pregnancy or mental disorder. You can only receive benefits for a maximum of 26 weeks.

For the benefit waiting period and while the Short-Term Disability benefits are payable, you are considered disabled if you:

• you are limited from performing the material and substantial duties of your regular

occupation; and

• you have a 20% or more loss in weekly earnings due to the same sickness or injury.

Contributions:

This benefit is 100% employer paid.

Eligibility:

All staff who work a minimum of 30 hours per week are eligible for coverage on their date of hire. Faculty are not eligible for this benefit.

Your Long Term Disability Benefits

This benefit helps provide financial protection for insured members by promising to pay a monthly benefit in the event of a covered disability. Please refer to your Employee Certificate for the definition of disability. Your monthly benefit is 66 2/3% of monthly pre-disability earnings, reduced by deductible income which include work earnings, workers’ compensation, state disability, etc. The maximum amount that can be received is $9,500/month.

The waiting period for this benefit to become payable is 180 days. This benefit includes a zero-day residual, an accelerated elimination period, and a work incentive benefit during the first 12 months of disability payments.

If you are unsure which class you are a part of, please contact Human Resources.

Contributions:

This benefit is 100% employer paid.

Eligibility:

All employees who work a minimum of 30 hours per week are eligible for coverage on their date of hire.

My Voluntary Life and AD&D Benefits

Employees can elect a benefit amount for voluntary life and/or voluntary accidental death and

dismemberment in $10,000 increments to a maximum of 5x your annual earnings up to $500,000. Evidence of Insurability is typically needed when an applicant enrolls above the non-medical maximum (or guaranteed issue) amount of $200,000, or enrolls outside their initial enrollment window, or was previously declined.

Employees can elect voluntary life and/or voluntary accidental death and dismemberment on their spouse in $5,000 increments. The benefit must be the lesser of 100% of the Employee’s Voluntary Life benefit or $250,000. Any amounts over $30,000 will be subject to Evidence of Insurability. Employee can elect voluntary life and/or voluntary accidental death and dismemberment on their child.

Birth to 14 days: $1,000.

14 days to 6 months: $1,000.

6 months to 19 years (26 years if Full-Time Student): $2,000 increments up to $10,00

Contributions:

This is an employee paid benefit.

Eligibility:

Faculty & Staff working 30 hours per week are eligible for this coverage on their date of hire.

My Voluntary Accident Benefits

Voluntary Accident

Group Accident insurance is designed to help covered employees meet the out-of-pocket expenses and extra bills that can follow an accidental injury, whether minor or catastrophic. Indemnity lump sum benefits are paid directly to the employee based on the amount of coverage listed in the schedule of benefits. The accident base plan is guaranteed issue, so no health questions are required.

Contributions:

Coverage is paid 100% by the employee.

Eligibility:

Staff working 30 hours per week are eligible for this coverage on their date of hire.

My Voluntary Critical Illness Benefits

Voluntary Critical Illness

Critical Illness insurance is designed to help employees offset the financial effects of a catastrophic illness with a lump sum benefit if an insured is diagnosed with a covered critical illness. Every year, each family member who has Critical Illness coverage can also receive $75 for getting a health screening test, such as: blood tests, chest x-rays, stress tests, colonoscopies, mammograms and other tests listed in your policy.

Contributions:

Eligibility:

Staff working 30 hours per week are eligible for this coverage on their date of hire.

My Pet Insurance Benefit

Vermont Law School is now offering Pet Insurance through PinPaws!

Benefits of Pet Insurance through Pin Paws:

- Coverage for Cats and Dogs of All Ages and Breeds*

- No Initial Exam/ Past Vet Notes Required

- Accident Coverage Starts at Midnight

- Customizable Deductible and Out- of- Pocket Max

- Annual Max Payouts as Opposed to Per Incident

- Choose Your Reimbursement Percentage

- Multiple Value- Added Benefits Included

- Routine Care Option Available with Customized Plans*

- Available in all 50 States!

Frequently Asked Questions

How long does a claim take?

The average time from start to finish when submitting a claim to MetLife is 10 business days.

What is Pin Paws Pet Care and what are the different options?

The Pin Paws Pet Care (pet insurance) plan is an accident and illness policy for dogs and cats. We do offer a Wellness Rider for an additional cost. Our Standard Wellness Rider is an excellent choice for pet parents who would like coverage for routine and preventative expenses in addition to their pet insurance coverage.

What does standard wellness cover?

Standard Wellness covers the cost of the following:

- Annual vet exam

- Lab work

- Recommended vaccinations

- Teeth cleaning

- Spay and Neuter Services

- Flea, Tick, and Heartworm Prevention

Your Employee Assistance Program Benefit

Vermont Law and Graduate School offers an Employee Assistance and Mental Health

Program to all employees – free of charge! Work and personal challenges can affect your

health and well-being. At some point in our lives, we could all use a little extra help. ESI EAP

is available 24 hours a day, 365 days a year.

Confidentiality is the hallmark of the program and is essential to the success of the program and is no different than using any of your other benefits such as medical, dental or vision. Nobody besides the person accessing EAP knows that they’ve gone or why, unless they tell

someone

In addition to phone-based help, a lot of information can be found online, such as self-assessment tools, interactive databases, health and wellness calculators, webinars and podcasts.

Licensed professionals provide confidential support and guidance related to:

Contributions

Premiums are paid for by the employer.

Eligibility

All employees who work a minimum of 30 hours per week are eligible for coverage on their date of hire.

Plan Documents

Your Travel Assistance Benefit

Vermont Law and Graduate School offers Travel Assistance through Mutual of Omaha.

We know experiencing an emergency while traveling can be especially difficult. Knowing who to call for medical problems, currency exchange issues or lost luggage is critical. Take comfort in knowing that Travel Assistance travels with you worldwide, offering access to a network of

professionals who can help you with local medical referrals or provide other emergency assistance services in foreign locations.

Contributions:

There is no cost associated with Travel Assistance.

Eligibility

All employees who work a minimum of 30 hours per week are eligible for coverage on their date of hire. Employees must participate in the basic life to receive this benefit.

Your Identity Theft Recovery Benefits

Vermont Law and Graduate School offers Protection to Identity Theft through Mutual of Omaha.

Your Travel Assistance benefit automatically includes Identity Theft Assistance, coordinated at no additional cost. Whether at home or traveling, this benefit provides education, prevention and recovery information to help you protect our identity.

Contributions:

There is no cost associated with ID Theft Recovery Services.

Eligibility:

All employees who work a minimum of 30 hours per week are eligible for coverage on their date of hire. Employees must participate in the basic life to receive this benefit.

Your Retirement Benefits

Vermont Law and Graduate School offers a retirement plan to employees through TIAA CREF. Employees working more than 20 hours a week are eligible for discretionary employer

contributions of 4% upon hire. There is no waiting period for discretionary employer

contributions. However, there is a one full plan year vesting for those contributions.

30 days after their date of hire, new hires who are hired to work 20 hours or more per pay

period will be automatically enrolled in the VLGS 403(b) through TIAA at a 3% salary deferral.

Mid-July each year, VLGS auto-escalates all enrolled participants in the 403(b) by 1%, up to a

ceiling of 10%.

Employees may make pre-tax contributions up to a maximum of $23,000 for 2025. This

includes contributions made to other deferral plans. If an employee turns age 50 before the

end of any calendar year, they may defer up to an extra $7,500 each year.

In addition to tax-deferred contributions, employees may not have total contributions of more

than $68,000, plus any age 50 catch-up contributions or an amount equal to 100% of

compensation, whichever is less.

Eligibility:

Eligibility may vary. Please see human resources for more information. There is no waiting period.

Your Will Preparation Benefits

We know creating a will is an important investment in your future. It specifies how you want your possessions to be distributed after you die. Whether you’re single, married, have children or are a grandparent, you will should be tailored for your life situation.

Epoq, the service provider, offers a secure account space that allows you to prepare wills and other legal documents. Create a will that’s tailored to your unique needs from the comforts of your home.

Contact Information

Create your will at www.willprepservices.com and use the code MUTUALWILLS to register.

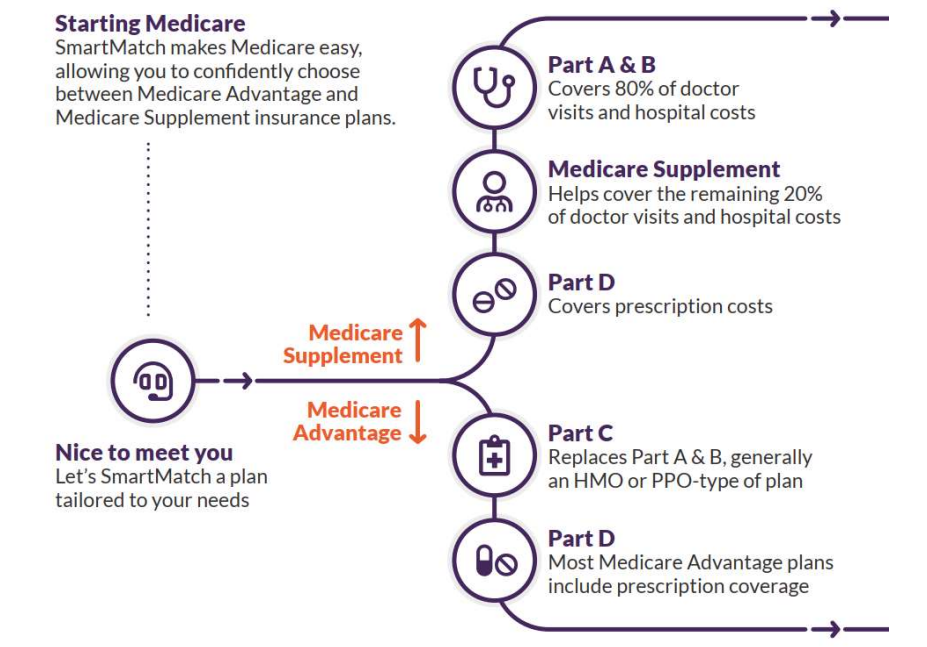

SmartConnect – Medicare Resource

Medicare is very complex, and it is important that you have an advocate who can provide you the proper Medicare education and guidance.

There are different paths you can choose in Medicare plans, and it can be very time consuming and difficult to filter through these options yourself. It is important that you find the appropriate plan in your area that best fits your medical needs and is within your financial budget.

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Contact Information

1-833-502-2747 | TTY:711

For more information or to get started, please click on the following link:

Additional Information

Other Documents

My Tuition Assistance Benefit

Tuition Reimbursement

The Vermont Law School tuition assistance program is designed to help employees pay back student loan debt and improve their financial well-being.

Utilizing Vermont Law School’s relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefit program that is revolutionizing the way employees can reduce their student loan debt.

GradFIN will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

For more information or to schedule a one-on-one consultation visit:

Eligibility:

In order to participate in the plan, you must satisfy certain age and service conditions under the plan:

Minimum age requirement: In order to participate in the plan, you must be at age 21.

Contact Information

GradFIN

For more information or to schedule a 15-minute appointment with a GradFin Consultation Expert click HERE!

Phone: (844) GRADFIN

Plan Information

My Perks & MemberDeals Discounts

For more information please contact Human Resources

Perks

America Mattress

In support of our local businesses and colleges, we would like to offer a 10% discount to employees and students on purchases at our West Lebanon location.

For more information:

Irving Oil

Vermont Law School and Irving Energy have teamed up to offer you special discounted pricing on fuel and home heating equipment. You can save 15 cents per gallon off heating, or 30 cents per gallon off propane. Other savings include gas and equipment.

For more information:

Comparion

With Comparion Insurance, you’ll get a dedicated local agent who will explain all of your auto and home coverage options in clear terms and help you choose the insurance that best fits your needs.

Get information or help anytime at ComparionInsurance.com.

Working Advantage

Vermont Law School is pleased to offer Working Advantage. Save up to 60% on tickets, travel and shopping.

For more information:

MemberDeals Discounts

Vermont Law School employees have now access to huge savings on nationwide entertainment through MemberDeals. Find exclusive discounts, special offers, preferred seating, and tickets to top attractions, theme parks, shows, sporting events, hotels and much more.

- Save up to 40% on Top Theme Parks Nationwide

- Save up to 60% on Hotels Worldwide

- Save up to 40% on Top Las Vegas & Broadway Show Tickets

- Huge Savings on Disney & Universal Studios Tickets

- Preferred Access Tickets™ Find great seats to your favorite concerts, sports and more!

My Wellness Outlet

Vermont Law School offers employees discounts through the Wellness Outlet!

Enter account code RICHARDSGRP at The Wellness Outlet for access to discounts of 18-40% off retail price of fitness trackers from Fitbit and Garmin, plus free shipping to your home.

The Wellness Committee is dedicated to fostering a supportive environment that encourages overall well-being. We provide resources, activities, and services to help you make healthy lifestyle choices.