My Medical Benefits

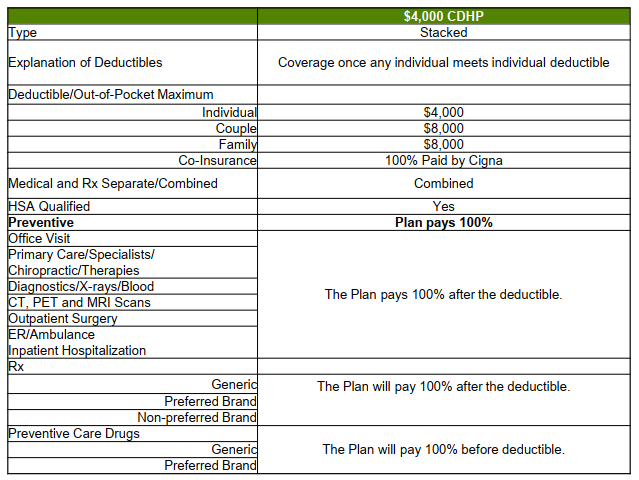

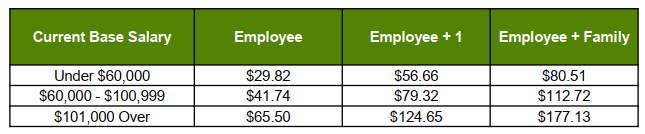

Vermont Law School offers one (1) medical plan to its eligible faculty & staff. Coverage is provided through Cigna. Below is a snapshot of the benefits. For more complete information, refer to the SBCs and/or Certificate of Coverages.

Vermont Law School will support your decision to set aside pre-tax dollars into an individual account with the financial institution of your choice by withholding contributions and forwarding the contribution to the HSA trustee on your behalf. Employees will need to fill out a payroll deduction form to initiate the contributions being forwarded to HSA account.

Contributions

Eligibility

Faculty & Staff who work a minimum of 30 hours per week are eligible for this benefit on their date of hire.

HRA Information

Pharmacy Information

Other Plan Information

Network Information

Forms

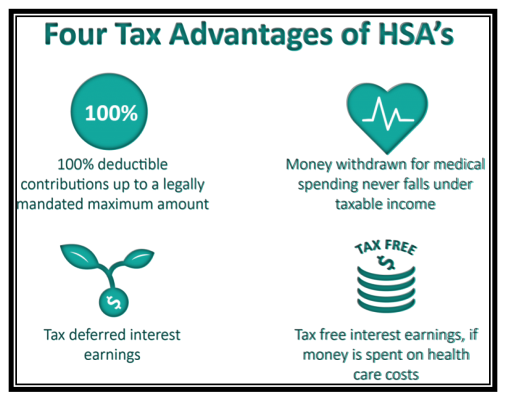

My HSA Benefits

My Health Savings Account Benefits

Vermont Law and Graduate School will set aside an employer contribution into an individual Health Savings Account with a partnership between TIAA-CREF and Health Equity. VLGS provides $2,500 toward your individual Health Savings Account and encourage employees to do the same.* The IRS has increased the maximum contribution for 2023 to $3,850 for individual and $7,750 for a family. The maximums include the contribution that VLGS gives employees. For participants over the age of 55 the IRS allows an additional $1,000 to be contributed. The funding provided by Vermont Law and Graduate School will be prorated for 2023 new hires.

Anyone who is ineligible for a Health Savings Account will receive a Health Reimbursement Account (HRA). VLGS will put $2,500 into this account for eligible medical expenses.

Eligibility:

Faculty & Staff who work a minimum of 30 hours per week are eligible for this benefit on their date of hire if enrolled in the Health Savings Account medical plan.

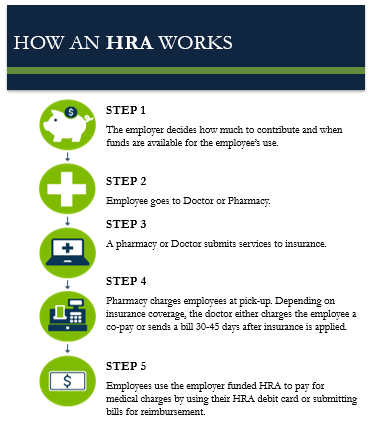

My HRA Benefits

My Health Reimbursement Account Benefits

Vermont Law and Graduate School employees who enroll in medical coverage and who elect the Health Reimbursement Account due to enrollment in Medicare will receive $2,500 of funding to assist with reaching their annual deductibles. The funding provided by Vermont Law and Graduate School will be prorated for 2023 new hires

Eligibility:

Faculty & Staff who work a minimum of 30 hours per week are eligible for this benefit on their date of hire if enrolled in the Health Savings Account medical plan.

My FSA & DCA Benefits

An FSA is an annual election whereby an employee can elect to make pre-tax contributions to:

- The IRS does not allow an employee to have a Health Savings Account and a Medical Flexible Spending Account (FSA). Due to this change, VLGS will only allow FSA accounts for employees who are ineligible for a Health Savings Account and who will receive a Health Reimbursement Account in lieu of an HSA.LIMITED PURPOSE FLEXIBLE SPENDING ACCOUNT (LPFSA)Funds may be used for only vision and dental expenses. Limited Purpose Flexible Spending Accounts may be used alongside your Health Savings Accounts. When coordinated with an HSA, the LPFSA can further reduce your taxes while allowing you to allocate HSA funds for other purposes – including retirement.Funds are available in full on January 1st and must be used by December 31st of the same year.Maximum Election is up to the IRS maximum for LPFSA.*Participants may roll over $610.00 into the following plan year.DEPENDENT CARE ACCOUNT (DCA)VLGS will continue the Dependent Care Account (DCA) with Health Equity. You may use these contributions to pay for expenses associated with providing care to children under age 13. You may elect up to a maximum of $5,000, depending on your tax filing status. Any unused dollars will be forfeited.Maximum salary reduction:$5,000 for a single employee or a married employee filing a combined tax return$2,500 for a married employee filing a separate tax return

Eligibility:

Faculty & Staff who work a minimum of 30 hours per week are eligible for this benefit on their date of hire.

Plan Information

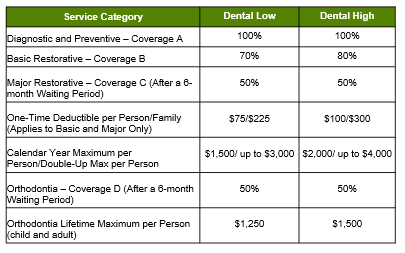

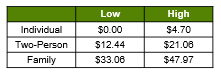

My Dental Benefits

The Vermont Law School offers two (2) dental plans to its employees:

Local Dentist Search – Please be aware that you can choose from PPO or PREMIER networks.

Northeast Delta Dental Videos

Contributions

Eligibility:

Faculty & Staff who work a minimum of 30 hours per week are eligible for this benefit on their date of hire. Eligible dependents include spouse and dependent children to age 26.

Plan Information

Important Documents

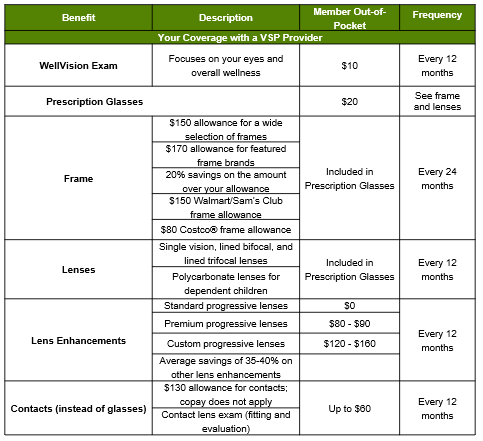

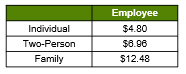

My Vision Benefits

Plan Information

My Group Life and AD&D Benefits

Vermont Law School provides Basic Life & Accidental Death & Dismemberment (AD&D) Insurance to all eligible employees at 2 x your annual earnings, up to $300,000 .

Contributions

Group Life premium is paid by the company.

Eligibility:

All employees who work a minimum of 30 hours per week are eligible for coverage on their date of hire.

Your Short Term Disability Benefits

Vermont Law School provides Short Term Disability Coverage to eligible employees.

Contributions:

Short Term Disability Premiums are paid for by the employer.

Eligibility:

All staff who work a minimum of 30 hours per week are eligible for coverage on their date of hire. Faculty are not eligible for this benefit.

Your Long Term Disability Benefits

Vermont Law School provides Long Term Disability Coverage to eligible employees.

If you are unsure which class you are a part of, please contact Human Resources.

Contributions:

Long Term Disability Premiums are paid for by the employer.

Eligibility:

All employees who work a minimum of 30 hours per week are eligible for coverage on their date of hire.

My Voluntary Life and AD&D Benefits

Employees can elect a benefit amount for voluntary life and/or voluntary accidental death and dismemberment in $10,000 increments to a maximum of 5x your annual earnings up to $500,000. Any amounts over $200,000 will be subject to Evidence of Insurability.

Employees can elect voluntary life and/or voluntary accidental death and dismemberment on their spouse in $5,000 increments. The benefit must be the lesser of 100% of the Employee’s Voluntary Life benefit or $250,000. Any amounts over $30,000 will be subject to Evidence of Insurability.

Employee can elect voluntary life and/or voluntary accidental death and dismemberment on their child.

- Birth to 14 days: $1,000

- 14 days to 6 months: $1,000

- 6 months to 19 years (26 years if Full-Time Student): $2,000 increments up to $10,000.

Contributions:

This is an employee paid benefit.

Eligibility:

Faculty & Staff working 30 hours per week are eligible for this coverage on their date of hire.

My Voluntary Accident Benefits

Voluntary Accident

Group Accident insurance is designed to help covered employees meet the

out-of-pocket expenses and extra bills that can follow an accidental injury, whether minor or catastrophic. Indemnity lump sum benefits are paid directly to the employee based on the amount of coverage listed in the schedule of benefits. The accident base plan is guaranteed issue, so no health questions are required.

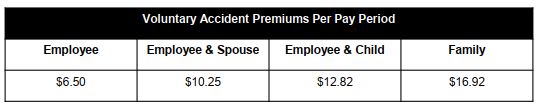

Accident Contributions:

Eligibility:

Faculty & Staff working 30 hours per week are eligible for this coverage on their date of hire.

My Voluntary Critical Illness Benefits

Voluntary Critical Illness

Critical Illness insurance is designed to help employees offset the financial effects of a catastrophic illness with a lump sum benefit if an insured is diagnosed with a covered critical illness.

Critical Illness Contributions:

Eligibility:

Faculty & Staff working 30 hours per week are eligible for this coverage on their date of hire.

Your Employee Assistance Program Benefit

Vermont Law School provides all employees with an Employee Assistance Program (EAP) through ESI Employee Group, an independent, industry-leading company that specializes in total care management. EAP is a voluntary, confidential service that provides professional counseling and referral services designed to help with personal, job or family related problems.

EAP consultants are available 24 hours a day, 7 days a week, 365 days a year. Any services provided by the EAP counselors are at no charge to you or your family members.

In addition to phone-based help, a lot of information can be found online, such as self-assessment tools, interactive databases, health and wellness calculators, webinars and podcasts.

Licensed professionals provide confidential support and guidance related to:

- Family, relationship and parenting issues

- Basic child and elder care needs

- Emotional and stress-related issues

- Conflicts at work or home

- Alcohol and drug dependencies

- Personal development and general wellness issues

- Financial issues

- Legal issues

- They can also refer you for in-person counciling

Vermont Law School’s EAP through ESI Employee Group is a confidential service. No one will know if you use the EAP-not your supervisor, Vermont Law School, or your family members.

Contributions

Premiums are paid for by the employer.

Eligibility

All employees who work a minimum of 30 hours per week are eligible for coverage on their date of hire.

Your Travel Assistance Benefit

Travel Assistance is available to employees and their dependents who are traveling 100 or more miles from home. Travel Assistance helps you locate hospitals, embassies and other “unexpected” travel destinations. One phone call connects you and your family to medical and other important services 24 hours a day. You will have access to hospital admission assistance, prescription replacement assistance, care and transport of unattended minor children, emergency message services, emergency trauma counseling, legal and interpreter referrals, and more.

Eligibility

All employees who work a minimum of 30 hours per week are eligible for coverage on their date of hire. Employees must participate in the basic life to receive this benefit.

Contributions:

There is no cost associated with Travel Assistance.

Your Identity Theft Recovery Benefits

Vermont Law School offers Identity Theft Recovery Services through Mutual of Omaha to all VLS Employees at no additional cost.

Eligibility:

All employees who work a minimum of 30 hours per week are eligible for coverage on their date of hire. Employees must participate in the basic life to receive this benefit.

Contributions:

There is no cost associated with ID Theft Recovery Services.

Individual Life Insurance Policies

While nothing can replace you, having individual life insurance can protect your loved ones financially. The Richards Group is please to offer a simplified, 100% online solution to get individual life insurance coverage.

- No in-person medical exam necessary

- Just answer a few easy questions about your current health

- View options that fit your needs and budget

- Our AI-powered recommendation engine pulls options from trusted insurance agencies tailored to you and your family’s unique situation needs.

- Select and purchase a plan

- Get qualified instantly, or schedule an online consultation to determine the best fit. No need to wait for open enrollment – your plan is active in just 1-3 weeks from initial selection.

Your Retirement Benefits

Vermont Law School offers a retirement plan to employees through TIAA CREF.

Employees may elect to make tax-deferred contributions as soon as administratively feasible following hire. To be eligible for discretionary employer contributions employees must complete two (2) consecutive years of service. Your initial eligibility measuring period will be the 12-month period beginning with your date of hire. If you do not satisfy the eligibility requirements during that first measuring period, eligibility will be calculated based on the Plan Year. Employees will be credited with a year of service if they work at least 1,000 hours during the eligibility measuring period.

Employees may make pre-tax contributions up to a maximum of $20,500 for 2022. This includes contributions made to other deferral plans. If an employee turns age 50 before the end of any calendar year, they may defer up to an extra $6,500 each year.

In addition to tax-deferred contributions, employees may not have total contributions of more than $67,500, plus any age 50 catch-up contributions or an amount equal to 100% of compensation, whichever is less.

Vermont Law School will select the investment vendors and options that will be available under the plan.

ROTH CONTRIBUTION OPTION

Vermont Law School offers a Roth contribution option to its Retirement Plan – another tool you can use to save for your financial future.

When you contribute to the Retirement Plan, your pretax contributions have the potential to accumulate tax deferred and withdrawals are taxable. With the Roth option, your after-tax contributions have the potential to accumulate tax free. If you satisfy plan and tax law requirements, you can withdraw your Roth contributions in retirement without paying additional taxes. Note that Roth contributions are included when calculating contribution limits.

Withdrawals of earnings prior to age 59½ are subject to ordinary income tax and a 10% penalty may apply. Earnings can be distributed tax free if distribution is no earlier than five years after contributions were first made and you meet at least one of the following conditions: age 59½ or older or permanently disabled. Beneficiaries may receive a distribution in the event of your death.

Eligibility:

Eligibility may vary. Please see human resources for more information. There is no waiting period.

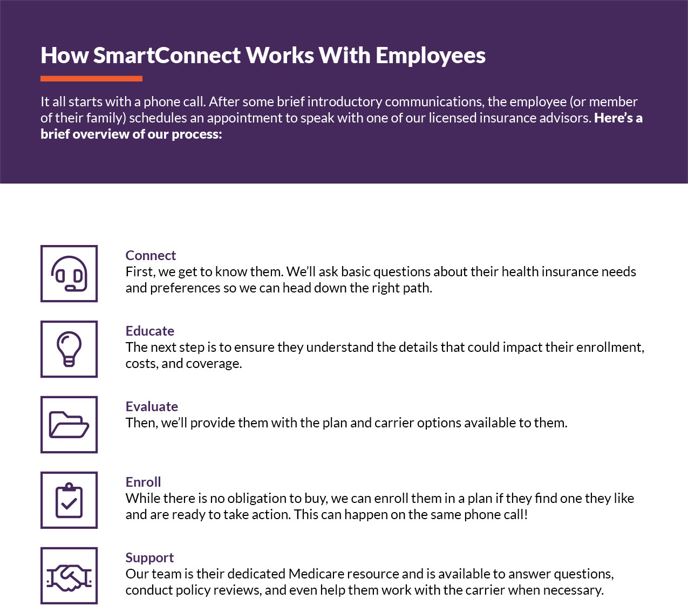

SmartConnect – Medicare Resource

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Contact Information

For more information or to get started, please click on the following link:

Additional Information

Other Documents

My Tuition Assistance Benefit

Tuition Reimbursement

The Vermont Law School tuition assistance program is designed to help employees pay back student loan debt and improve their financial well-being.

Utilizing Vermont Law School’s relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefit program that is revolutionizing the way employees can reduce their student loan debt.

GradFIN will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

For more information or to schedule a one-on-one consultation visit:

Eligibility:

In order to participate in the plan, you must satisfy certain age and service conditions under the plan:

Minimum age requirement: In order to participate in the plan, you must be at age 21.

Contact Information

GradFIN

For more information or to schedule a 15-minute appointment with a GradFin Consultation Expert click HERE!

Phone: (844) GRADFIN

Plan Information

My Perks & MemberDeals Discounts

For more information please contact Human Resources

Perks

America Mattress

In support of our local businesses and colleges, we would like to offer a 10% discount to employees and students on purchases at our West Lebanon location.

For more information:

Liberty Mutual

As an affiliate of Vermont Law School, you could save up to 10% on quality auto and 5% on home insurance tailored to your needs. This includes valuable protection you can trust and service when & where you need it.

For more information visit: www.libertymutual.com/Vermont-Law-School

Irving Oil

Vermont Law School and Irving Energy have teamed up to offer you special discounted pricing on fuel and home heating equipment. You can save 15 cents per gallon off heating, or 30 cents per gallon off propane. Other savings include gas and equipment.

For more information:

Working Advantage

Vermont Law School is pleased to offer Working Advantage. Save up to 60% on tickets, travel and shopping.

For more information:

MemberDeals Discounts

Vermont Law School employees have now access to huge savings on nationwide entertainment through MemberDeals. Find exclusive discounts, special offers, preferred seating, and tickets to top attractions, theme parks, shows, sporting events, hotels and much more.

- Save up to 40% on Top Theme Parks Nationwide

- Save up to 60% on Hotels Worldwide

- Save up to 40% on Top Las Vegas & Broadway Show Tickets

- Huge Savings on Disney & Universal Studios Tickets

- Preferred Access Tickets™ Find great seats to your favorite concerts, sports and more!

My Wellness Outlet

Vermont Law School offers employees discounts through the Wellness Outlet!

Enter account code RICHARDSGRP at The Wellness Outlet for access to discounts of 18-40% off retail price of fitness trackers from Fitbit and Garmin, plus free shipping to your home.